Understanding how to navigate your home expenses is a good step towards financial empowerment, whether you’re a first-time homeowner in the UK or looking to refine your financial strategy.

Let’s delve into the complexities of budgeting, focusing on UK homeowners new to the world of financial planning. From determining your income and expenses to mastering the art of negotiation and smart shopping, we’ll look at practical ways to turn household expenditures into money-saving machines.

It can be hard to keep household expenses low over the festive season as we naturally spend more time indoors with our friends and family. So here’s how to turn your home expenses into savings opportunities with practical, easy-to-follow advice.

8 Tips to Mastering Your Home Expenses

Making a budget and turning your household expenses into savings machines requires careful planning, discipline, and strategic decision-making. As every household is unique, the advice below will be a reference guide to help get the ball rolling rather than a step-by-step guide. With that in mind, here are 8 tips and tricks to help you budget like a pro and turn your household expenses into savings opportunities:

1. Understand Your Income and Expenses

Begin by meticulously documenting all sources of income, including your salary, bonuses, and any other earnings. Concurrently, categorise your expenses into fixed necessities, such as mortgage payments and utility bills, and variable costs, such as groceries and entertainment. This procedure creates a clear picture of your financial inflows and outflows.

2. Establish a Budget

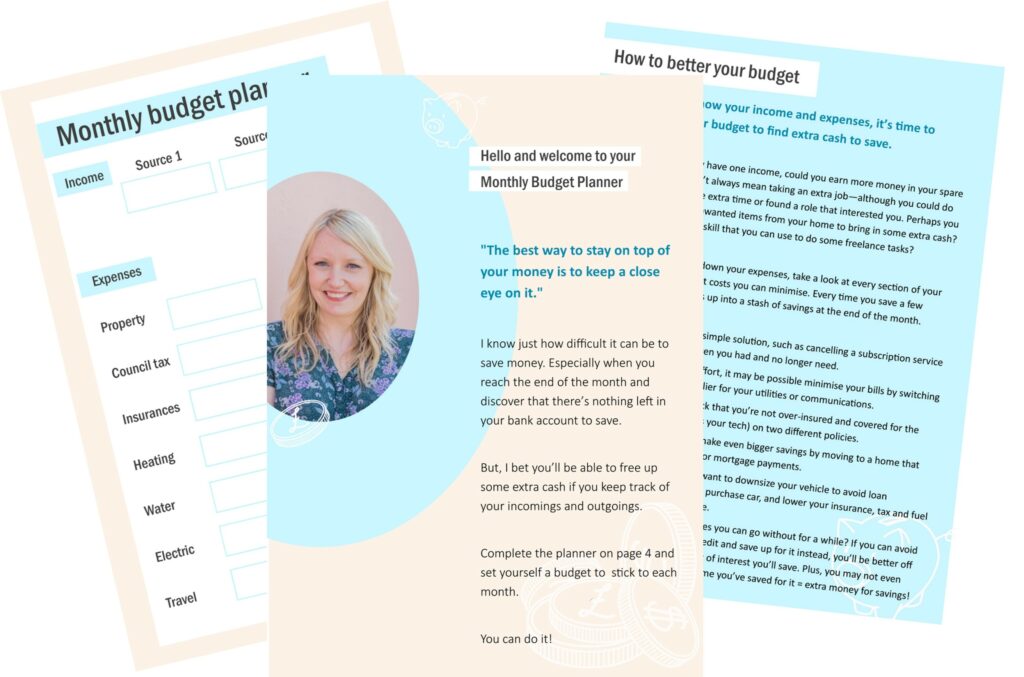

Creating a realistic budget entails more than just allocating funds; it also entails defining your financial goals. Set specific goals, such as saving for home improvements or creating an emergency fund. Once you’ve established your goals, divide your spending into necessities (like mortgage payments, council tax, and utility bills) and discretionary expenses (like dining out or entertainment). If you need a hand with this check out my budget template in my resources library.

3. Cut Unnecessary Expenses

Investigate your lifestyle choices and identify areas where changes can be made without affecting your quality of life. Consider cooking at home instead of eating out or taking public transport instead of owning a car. Engaging in cost-effective do-it-yourself (DIY) projects for home maintenance and improvements is another way to save money without sacrificing your home’s safety.

Ensure that when you take on DIY projects within your skill level, having a professional fix your mistakes can be more costly as they still do the job, and you pay for the material you used during your attempt. Let’s not even talk about the chances of worsening the situation. Knowing when it’s a DIY and a professional job is just as important.

4. Categories and Prioritise Expenses

Examine your monthly spending and allocate a significant portion of your budget to essential and fixed expenses such as mortgage payments, council tax, and utility bills. These are the foundations of your financial obligations. Make sure also to identify and scrutinise non-essential spending, determining where changes can be made without jeopardising your overall lifestyle.

5. Begin Automating Your Savings

Set up automatic transfers to a dedicated savings account as soon as your paycheck arrives in your bank account to make saving a non-negotiable part of your financial routine. This automated approach ensures consistency in saving over time, significantly contributing to your financial goals, whether for a specific purchase, an emergency fund, or long-term investments.

6. Start Building an Emergency Fund

Building an emergency fund is an integral part of achieving financial security. Set aside a certain percentage of your income for an emergency fund to amass three to six months’ living expenses. This fund is a safety net, providing a financial cushion to help you deal with unexpected expenses, job loss, or other challenges.

7. Review and Trim Subscriptions

Examine your subscriptions, from streaming services to monthly product subscriptions. Cancel those you rarely use and look into more cost-effective options for essential services. This declutters your expenses and ensures that the services you retain provide good value for money.

8. Negotiate and Shop Smart

In your quest for financial efficiency, consider optimising your regular bills. Negotiate better rates with your energy providers and consider energy-efficient alternatives to reduce your environmental impact and monthly costs. In addition, review and compare insurance policies regularly to ensure you have the most cost-effective coverage for your needs.

Get the Whole Family Involved

Navigating home budgeting is a collaborative effort that involves the entire family, not just the individual. Family budget meetings regularly provide a dedicated platform for discussing financial goals and fostering shared responsibility. The family gains a unified sense of purpose by collectively defining financial goals and visualising success with visual aids. Delegating age-appropriate responsibilities empowers each member while reinforcing their role in the household’s financial health.

Key steps include developing a transparent family budget, involving everyone in decision-making, and instilling financial education in children. Budgeting becomes an enriching, shared experience when parents lead by example and celebrate financial milestones together, laying the groundwork for a financially savvy and interconnected family unit.

Aside from foundational family budgeting practices, it is imperative to focus on substantial home expenditures, particularly heating and energy costs. An effective strategy involves the comparison of boiler quotations from reputable sources.

Considering the continuous advancements in home heating technology, investing in an energy-efficient boiler can notably diminish monthly bills. Through comparative analysis, families can procure boilers that offer optimal value in terms of energy efficiency, durability, and post-sale support, thereby transforming a potentially daunting expenditure into a prudent, cost-effective investment.

Converting your household expenses into savings powerhouses is more than just a financial strategy; it’s a whole-family approach. You strengthen your financial foundation and cultivate a sense of unity and financial literacy within your household through collaborative efforts, regular discussions, and shared responsibilities. As you embark on this journey together, you will create a legacy of financial well-being and resilience for future generations.

If you want to learn more ways to manage money better, visit my homepage cassiefairy.com.

Pin it for later

This blog post is an advertisement feature that has been written in collaboration with a sponsor. The pink links in this post indicate a sponsored link 🙂