I recently read a worrying report by the Children’s Society that one in 5 UK families are struggling with financial issues and suffering from ‘problem debt’ – meaning that they are a month behind on one or more bill payments. More importantly, the report highlighted the affect that this financial pressure was having on children, with many suffering with anxiety and being bullied at school because of their family’s problems. When I read details of the report I wanted to get involved to raise awareness of these personal finance issues so I’ve decided to join in with the #SpendingDiary campaign.

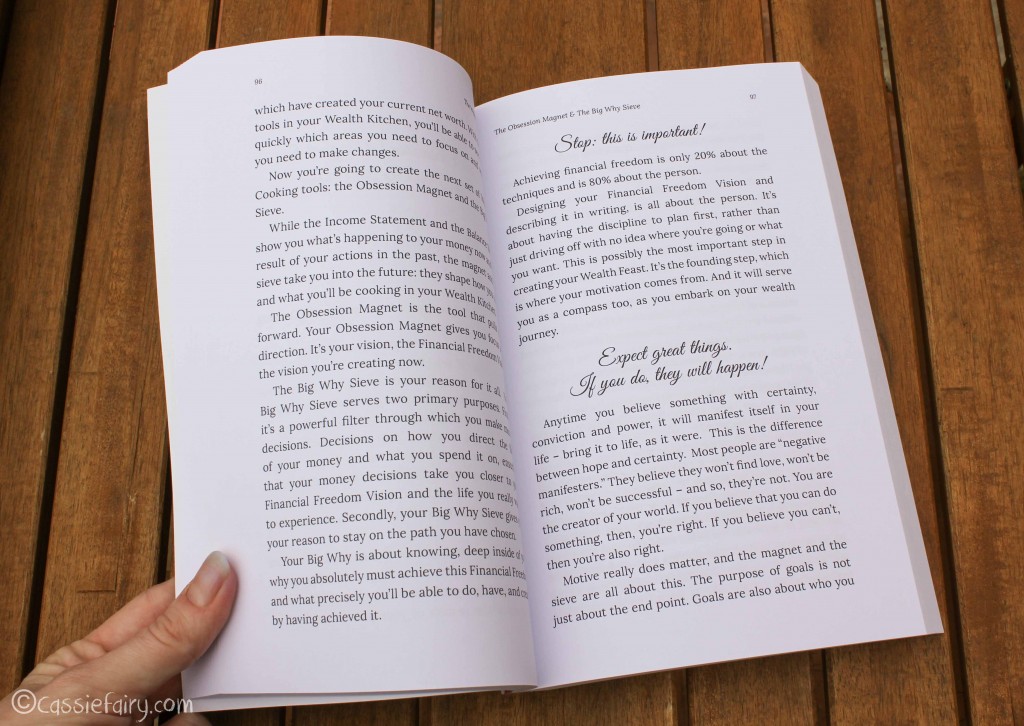

The Wealth Chef by Ann Wilson

I like to think that I’m rather well organised when it comes to sorting out my finances, but is hasn’t always been like this and I certainly struggled to make ends meet when I was a student! There’s nothing worse than being low on money with no idea of how to sort out the problem so this campaign is something that I really care about and the idea of putting some methods in place to keep track of money can only be a good thing! This is what I do at the moment to keep on top of my finances:

- Monthly spreadsheet on Excel which gives expected dates of money coming in and out (the dreaded bills) to show me how my bank account will balance at the end of the month and give me an idea of whether I need to cut back on anything during the month.

-

Pay my utility bills by monthly direct debit and always pay a little more than needed with the aim of always being ahead rather than getting a shock bill and being far behind (which happened a lot as a student!)

-

Try to save a little each month for emergencies (car breakdowns etc) and for Christmas

I am sure there are many more accounting techniques or money saving ideas that I could use to improve my personal finance so I’m going to get started with my #SpendingDiary today and run it for the entire month of June. I am going to use this diary below to keep track of my actual day-to-day spending – you know, the little bits of money that just disappear from your purse on cups of tea and car-parking – to see how much money I I realistically need but never budget for. Plus I’m going to see whether I can cut back on my weekly food bill by using this handy shopping list pad to ensure that I only buy the food I actually need for planned meals rather than randomly grabbing things from the supermarket shelves. Surely that will help me save money in the long run? We shall see!

You can keep track of my progress on Twitter using the hashtag #SpendingDiary and see what all the other bloggers in the campaign are spending their money on too. I’ll be sure to report back at the end of the month and let you know how I get on, whether it’s good news or bad!

This article is a sponsored collaboration. The pink links in the content indicate a sponsored link or information source. The blog post reflects my own experience and the sponsor hasn’t had any control over my content 🙂