Your home can be the source of some of your biggest outgoings, but that can also make it a great place to make some big savings. As part of my new year’s resolutions I wanted to start keeping an eye on my budget and save as much money as possible so I’ve been doing lots of research over the past couple of months into ways that I can reduce our monthly bills. I’ve come up with all sorts of ideas and whether its energy bills, the weekly food shop, or any other household expenditure, following the tips below can help you learn how to save money around the house.

Eat better for less

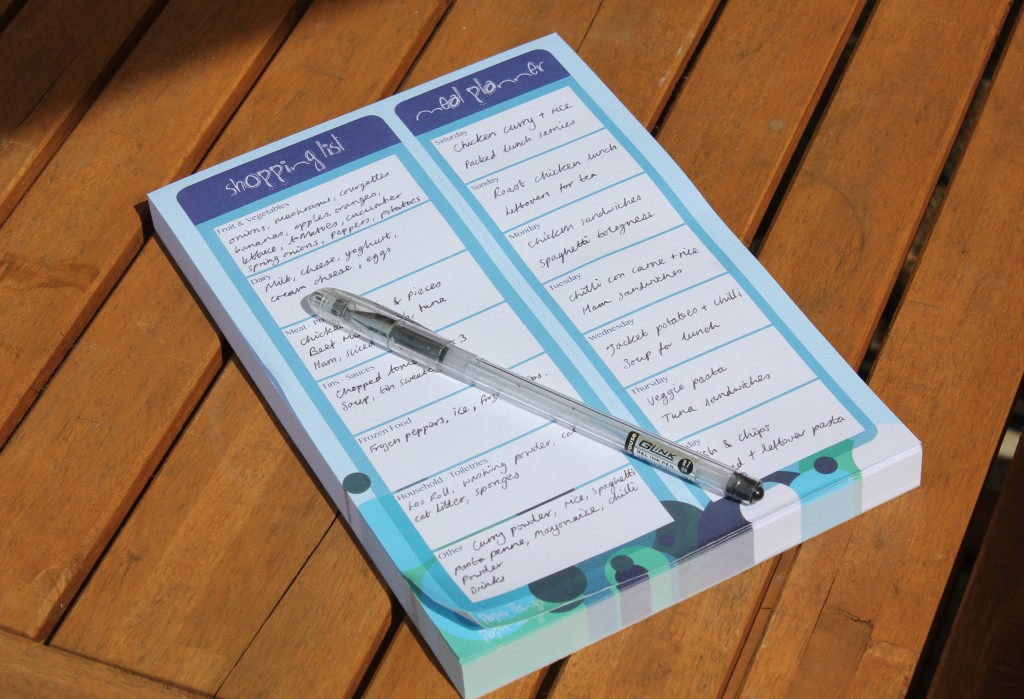

You’re always going to spend money on food, but by shopping more sensibly I’ve managed to cut down my expenses without cutting out flavour. Making a weekly meal plan allows me to buy in bulk and make multiple meals from similar sets of ingredients – such as spaghetti bolognese, cottage pie and chilli con carne – reducing my shopping bill and food waste. Planning ahead can also help you avoid unnecessary purchases, like those 3 for 2 deals you really don’t need – I’ve got a cupboard full of things I bought a year ago thinking I was getting a deal, oops!

Grow your own veg – I started last summer & can’t wait for more veggies this year!

Grow your own veg – I started last summer & can’t wait for more veggies this year!

It’s also worth trying to increase the number of vegetarian meals in your diet. Meat can be expensive and there’s a whole host of affordable, healthy and most importantly delicious vegetarian dishes out there. Even if you’re a big carnivore, vegetarian meals aren’t just rabbit food – I enjoyed a lovely vegetable curry this week and I’ll be sure to share the recipe with you soon.

Improve energy efficiency

There are plenty of ways that we can all improve our energy efficiency – saving money and making you feel better about helping the environment in the process. A good starting point is making sure that your home has loft and wall insulation as this can make a massive difference to your heating bill. After living in a freezing cold, uninsulated house – where a cup of water on my bedside table actually froze overnight – I place being warm in my own home at the top of my list of priorities. I read an online guide to saving energy this week and it’s been estimated that wall and loft insulation could save you in excess of £200 a year. Thankfully our bungalow is packed full of insulation so we never end up shivering like we did in the old farmhouse and I know that the heating we pay for is staying in the property rather than heating the roof tiles!

Even simple things like turning off lights when you leave the room and closing the curtains at night can make a huge impact on your energy bills, so there’s no need to make drastic lifestyle alterations. Sometime small changes translate into big savings and I’m sure that even filling the kettle with just enough water for my one cup of tea has made a difference over the course of the year.

Buying oil at the right time

There are thousands of UK households that are “off-the-grid,” relying on alternative sources for their energy. Heating oil is one of the most commonly used fuels outside of gas, but its price can fluctuate wildly due to a number of factors. Sometimes the price can really put you off investing in a tank of oil but you don’t have to be cold all winter long if you compare prices and only buy when the price drops. Companies like Boiler Juice monitor the changing price of heating oil over a period of years, so you can see how the current price matches up to its historic value and only buy when you know you’re getting a good deal. Other helpful tips to make your heating oil go further include regular boiler servicing and buying in bulk.

Scrutinise your expenses

If you don’t fully understand how much you’re spending, how can you possibly know where you can make savings? After keeping track of every penny for a month with my spending diary challenge, I’ve found that one of the most effective ways to save money around the home is to make a simple spreadsheet of all my monthly outgoings. When everything is in front of you in black and white you can start to seriously think about whether you need all 1,000 digital TV channels or such a big mobile data plan. Of course, it’s not about getting rid of the essentials, but recognising the things that you really won’t miss. Hubby and I have switched to pay as you go ‘goody bags’ for our mobile phones and are spending out a grand total of £5 per month for a basic calls, text and data package – and even then I don’t get through all my package allowances! If they did a £2.50 that would probably do me nicely!

Make money at home

It’s easy to think of your home in terms of potential outgoings, but you could actually be making money at home too. There are a number of online platforms that make it so easy to sell unwanted goods and make some spare cash. Sites like Gumtree provide an online market place for you to advertise in your local area, and you might be able to pick up some bargains yourself. After a great big new year clear out we ended up with lots of things that just didn’t fit in the house any more – furniture, books, clothing etc and we’ve been able to sell most of it online and have added a little extra to our savings jar in the process.

Let me know if you’ve found any more ways to make savings on your bills or have an interesting way to earn a little extra cash – I’d love to hear about it so please leave me a comment below.

This article is a sponsored collaboration. The pink links in the content indicate a sponsored link or information source. The blog post reflects my own experience and the sponsor hasn’t had any control over my content 🙂

3 responses

Shopping in different supermarkets to get the best prices is a great idea Ricky, I’m going to try this out for myself! You’ve just reminded me that I need to look out for a bargain slow-cooker too 🙂

Some really useful advice here Cassie. Whilst it can be difficult to save money – especially with it’s tight already – with a little planning and effort it can be done.

I’ve found the biggest expense we’ve been able to cut back on it our food shop. Cooking from scratch, meal planning, using the slow cooker and branding down are just a few things you can do to reduce your grocery spend. We also use mySupermarket to compare item prices and regularly shop in different supermarkets to get the best value.

I live suggestions regarding budgeting definitely a must great share http://lachiquitamissi.com