It’s the last month of the tax year and money is often a hot topic in March. The women at Buildalifeyou.love – a business which focuses on helping women build lives and careers they love – have created #MindfulMoneyMonth to help us all manage our money well. And I’ve got two copies of ‘Embrace Your Money Personality’ to give away to two lucky winners so read on to enter the competition below..!

Money worries topped a recent poll of “the biggest stress triggers” in the UK. Of the 2000 people surveyed, money caused more stress for them than work or relationship problems. So I think it’s important to tackle money issues head-on and Buildalifeyou.love’s new mindful approach seems to be a calm and reflective way to get your finances in order.

You may have spotted the Buildalifeyou.love’s motivational quotes and life hacks on Instagram throughout March, where they’ve been encouraging followers to join in with #MindfulMoneyMonth. One of the founders, Tracy said that they’d asked people what had been holding them back from working towards their financial goals, and that’s where it got complicated:

“In theory, if we get our budgeting and earnings right, it’s simply a case of working consistently and smartly towards our goal until we achieve it. So why doesn’t it work in practice? Some people couldn’t stop buying nice things even when they have a wardrobe full of clothes they haven’t worn. Some couldn’t stop going out even when it was out of their budget. Some people kept giving their loved ones money when they asked, even if it meant putting themselves in debt. Others found it really hard to save and some found it impossible to invest in things or themselves, even if they knew that would make them more financially secure in the long run. Hearing all these stories about people’s experiences with personal money management made us realise that it’s about more than basic money skills. It’s about unpicking our deep set beliefs and attitudes to money.”

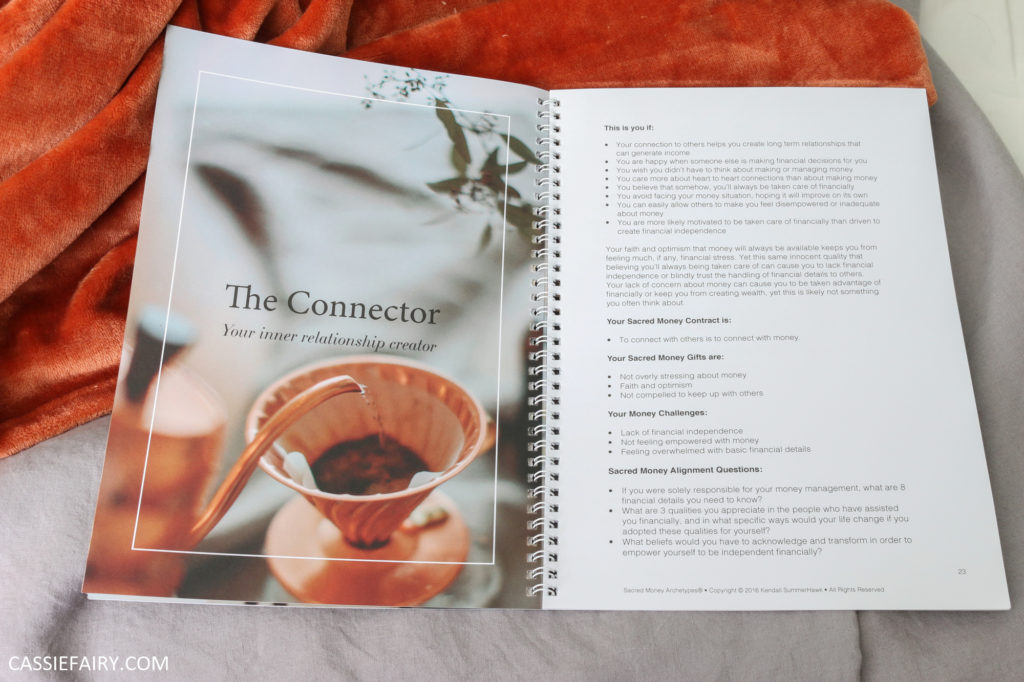

It’s easy to believe that some people “just better with money” than others, but Embrace Your Money Personality helps readers to discover their own individual “money personality”, or “Sacred Money Archetypes”, which were created by Kendall SummerHawk. The women at Build a life you.love used this technique to improve their own finances and want to share this with others.

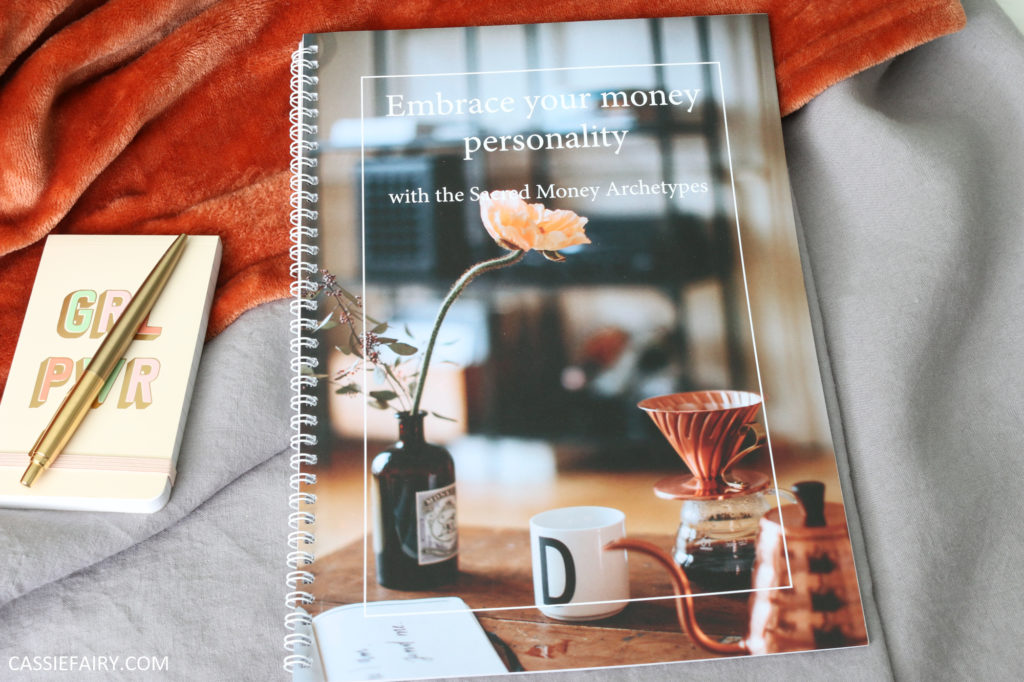

You can take the Sacred Money Archetypes assessment for free on the website. Once you’ve discovered your money personality there’s a digital download guide that can help you to understand your financial strengths and weaknesses, so you can really figure out what money means to you and the best way for you to approach it.

The good news is that you could win a printed copy of the complete guide in my blog giveaway! The booklet contains the assessment questionnaire, and shows you how to Embrace Your Money Personality to improve your finances and start saving for your big goals – brilliant! I’ve got two copies to give away to two lucky winners so enter via the Rafflecopter below – good luck!

a Rafflecopter giveawayGiveaway open to UK residents only. Competition runs from 22nd March to 11th April 2019. Winners will be contacted via email and will need to provide a delivery address to receive their prize.

Some items in this blog post have been gifted to me and the pink links indicate a gifted product, affiliate link or information source. All thoughts and opinions in this post are based on my own experience and I am not responsible for your experience 🙂

31 responses

saving up to buy our house x

I’m Saving up for a KitchenAid Mixer

I am saving up to move back to Spain next year!

A new PlayStation 2 console

Deposit for a house

a nice break away

I’m saving up as much as I can for my son and daughters christening

I’m saving up for a holiday in August to Italy.

If I had the luxury of being able to save it would be for a nice little holiday somewhere but alas all my money, like so many other peoples, goes on bills and the cost of living expenses.

going to Florida

We are saving to go abroad on holiday next year.

A holiday this summer.

I’m saving up for a new carpet for the stairs and landing.

A summer holiday

An extension to the side of the house x

I’m currently saving up to leave my job as I hate it.

Would love to trade up my car

Just completed saving for a gift for Mum. Something which I knew has meaning and sentiment for her. Need to start saving for spending money for weekend trip that fiancé has organised for us both.

Money does seem scarce, seems we are much in need of open-ness, honesty and transparency in regards to fuel prices, etc. Seems Energy Companies, Businesses, etc need to put Customers First. As many of the Public are totally disappointed with some Business practices :- Such as Philip Green. He is Super – Rich. Yet BHS ( British Home Stores) have gone, with employee pensions gone. Seems Businesses need to be Accountable for bad / negative practices. The public need shops, services of staff, etc. But want Value for Money. Good Service. Good Employee Practices from Businesses, etc.

Maybe we would all like to feel like Britain is Great again. Wellbeing is needed:- Such as a nice day out, a bargain, nice refreshments, sense of purpose, feeling valued / appreciated, etc, etc.

People work for a living. Quality of life is important. Finances can impact on Health and Wellbeing. Business bad / poor practice needs to be dealt with in order to provide / allow public health and wellbeing.

I’m saving up for a new combination microwave

A short break to recharge, preferably a spa day! x

daughter’s school trip – it’s a big one

Our family holiday to Devon in May xx

To go on holiday

Finish all Decorating in our House.

To go on holiday

A new laptop

A new phone.

To finish building our first house!

To finish builiding our first house!

a wee break away

Holiday but might not be able to this year. My son wants to go to Disneyland Paris.