I’ve been there myself: that uneasy feeling when bills pile up faster than you can tick them off, and the numbers simply don’t add up. It’s a horrible weight to carry, but it doesn’t have to stay that way. With a few practical tweaks and a dash of encouragement, you can start steering your finances back into calmer waters.

I’ve gathered some of the most helpful, down‑to‑earth ideas to help you feel more in control again, and I promise they’re easier to try than you might think.

Pause the outflow

When debt starts building, it can feel as though money is slipping through your fingers faster than you can catch it. That’s why the first step is simply to pause, take stock, and steady things. Think of it as putting your finances on “freeze mode” for a little while so nothing new gets added to the pile.

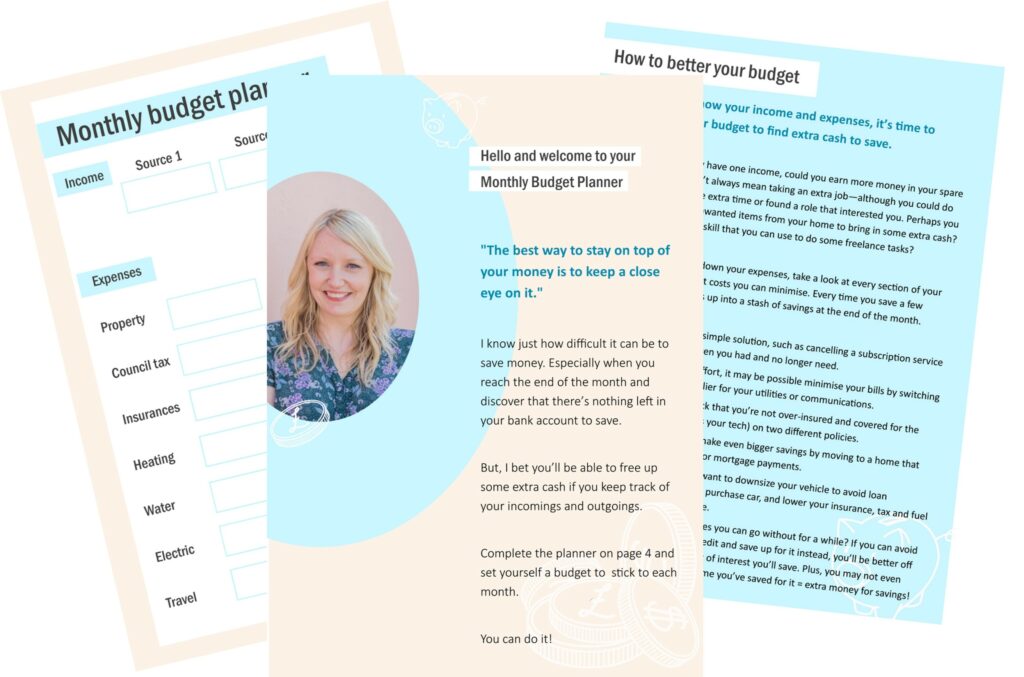

This might mean trimming your spending right back to the essentials, popping your credit cards in a drawer for safekeeping, and sketching out a short‑term budget that helps you get through the next few weeks without any extra pressure. You can download my budget planner here to help you make a start and discover ways to better your budget.

It’s not always easy – both practically and emotionally – but giving yourself this breathing space creates a much sturdier foundation to work from. Once the outflow has calmed down, you’ll be in a far better position to tackle the bigger picture.

Get professional advice

Once you’ve steadied things, it can be incredibly reassuring to chat with someone who really knows their stuff. Plenty of people have faced similar money worries, and there are professionals whose whole job is to guide you through the maze and help you find a clear way forward. So, it’s time to reach out for help.

I came across a lovely sentiment from debt‑settlement specialist Daniel Tilipman, who says he believes in “an empathetic approach that considers the emotional side of debt, not just the numbers.” That really resonated with me – because when you’re feeling overwhelmed, having someone who understands both the practical steps and the feelings behind them can make the whole process feel far less daunting.

Please seek out professional debt advice if you’re struggling with your finances and know that, no matter how difficult the situation seems at the moment, there WILL be a way out of it and your future will be better. In some cases, that might mean speaking with a trusted provider, such as a debt relief program, which works with individuals to help reduce and resolve qualifying unsecured debts in a more structured, manageable way. It’s just important to reach out and know that you’re not alone.

Consider snowballing your debt

One technique that lots of people swear by is the debt snowball method. It’s wonderfully simple: you start with your smallest balance, give it your full attention, and enjoy that little boost of achievement when it’s gone. That sense of progress can be surprisingly motivating, helping you build up speed and confidence as you move on to the next one and the next, until the whole pile feels much more manageable.

However, it’s worth noting that to pay off your smaller debt, you will also need to pay the minimum monthly payments on all of your other debts to ensure you retain a good relationship with your lenders and a positive credit record.

Make your payments smarter

You may also wish to consider restructuring your debt payments to make them work smarter. This often means speaking directly to creditors and explaining your situation, which can lead to them offering specific hardship options that may be more comfortable for you to keep up with.

Additionally, if you have the opportunity, negotiating lower interest rates wherever possible can help you deal with your debt, because it means you will be paying back less each month to help you make a dent in the debt and you’ll be repaying less overall.

Time your payments wisely

A little calendar‑juggling can make a big difference. Take a moment to line up your debt due dates with the days you’re paid, so you’re not caught short by a repayment you can’t afford halfway through the month. Instead, let your income arrive and then schedule your direct debits to go out shortly afterwards, so the repayments happen quietly in the background, worry-free.

It’s also worth leaving a little breathing room of a day or two, just in case your wages land late after a weekend or bank holiday, keeping everything running calmly and predictably. When your outgoings match your income rhythm, everything feels that bit calmer and easier to manage and you can keep on top of your responsibilities without the mid‑month wobble.

Tackling debt can feel overwhelming at first, but with a few steady steps – pausing the outflow, seeking kind, professional guidance, trying practical methods like the snowball approach, and smoothing out your monthly payment rhythm – you can gradually regain a sense of calm and control over your finances.

I’d love to hear how you’re getting on, so feel free to share your own tips or experiences in the comments below. And if you fancy a little more money‑saving inspiration, you might enjoy my post on ditching duplicate expenses to help you cut the cost of your regular outgoings.

Pin it for later

This blog post is an advertisement feature that has been written in collaboration with a sponsor. The pink links in this post indicate a sponsored link 🙂